Let’s talk about navigating the world of online payments safely and efficiently․ As a seasoned professional in e-commerce security, I often find that misconceptions surrounding «Non-Verified by Visa» (Non-VBV) credit cards and their role in online shopping create unnecessary anxieties․ This article aims to demystify this topic and empower you to make secure online purchases with confidence․

Understanding Non-VBV Credit Cards

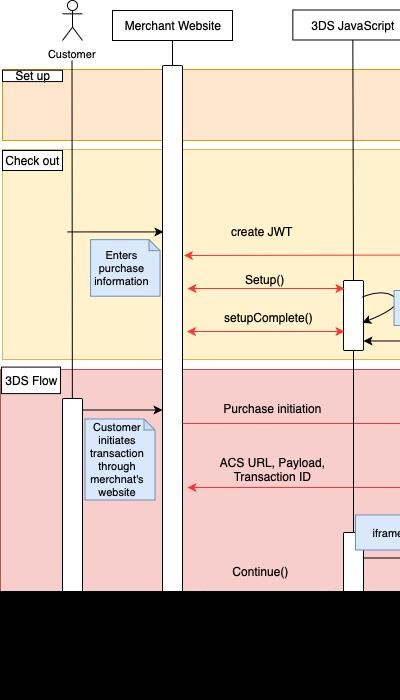

First, let’s clarify what Non-VBV means․ Unlike cards that require Verified by Visa (VBV) or MasterCard SecureCode authentication, Non-VBV cards don’t necessitate an extra step of verification during online transactions․ This often leads to quicker checkout processes, which is appealing to many shoppers․ However, this speed comes with a trade-off․ The absence of that extra layer of security inherently increases the risk of fraudulent activity․

The Security Implications

While the convenience of Non-VBV cards is undeniable, it’s crucial to understand the increased risk․ Without VBV or similar authentication, the potential for fraud increases significantly․ This is because the transaction relies solely on the credit card number, expiry date, and CVV․ Malicious actors can exploit vulnerabilities in less secure systems to perform unauthorized online purchases․

Mitigating Risks: Strategies for Safe Online Payments

So, how can we enjoy the speed of Non-VBV cards while maintaining robust e-commerce security? The key is to employ multiple layers of protection:

- Choose Reputable Merchants: Shop only on established websites with secure payment gateways․ Look for the padlock icon in the URL bar, indicating an HTTPS connection․ This ensures your e-commerce transactions are encrypted․

- Utilize Virtual Card Numbers: Many banks offer virtual card numbers․ These are temporary card numbers linked to your primary account, providing an extra layer of credit card safety․ If a virtual card is compromised, only the associated funds are at risk, not your entire account․ This is a powerful tool for fraud prevention․

- Strong Passwords and Multi-Factor Authentication (MFA): Employ strong, unique passwords for all your online accounts․ Enable MFA wherever possible to add an extra layer of transaction security․ This significantly reduces the chances of unauthorized access to your accounts and the associated digital payments․

- Monitor Your Accounts Regularly: Regularly review your bank and credit card statements for any suspicious activity․ Early detection is key in mitigating the damage of fraudulent online payments․

- Understand Your Credit Card Processing System: Be familiar with how your chosen payment processor handles credit card processing․ Understanding their security protocols and fraud prevention measures will give you greater peace of mind․

- Prioritize Internet Security: Maintain updated antivirus software and firewalls on all your devices to protect against malware that could compromise your internet security and steal your online shopping information․

The Bottom Line: Balancing Convenience and Security

While Non-VBV cards offer a faster checkout experience, they come with inherent security risks․ By understanding these risks and implementing robust protective measures, you can enjoy the convenience of quicker online purchases while maintaining high levels of secure online shopping․ Remember, safe online payments are a combination of smart choices and proactive security practices․ Don’t let the speed of Non-VBV cards compromise your credit card safety․