Hello there, aspiring FinTech enthusiasts! As a mentor in the payment processing industry, I’m thrilled to guide you through the fascinating evolution of credit card technology. From the humble beginnings of physical cards to the sophisticated world of digital transactions, we’ll explore the key milestones that have shaped how we buy and sell.

The Early Days: Magnetic Stripe and the Rise of Plastic

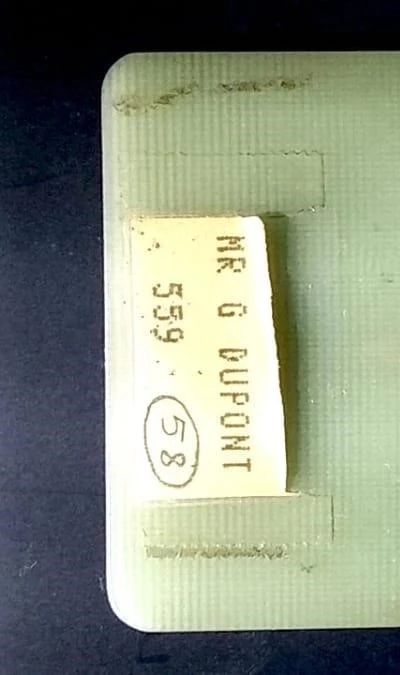

Our journey begins with the introduction of the magnetic stripe card. This simple yet revolutionary technology encoded cardholder data onto a magnetic strip, enabling automated transactions. Remember the satisfying swipe sound? While convenient, the magnetic stripe’s vulnerability to fraud, particularly through skimming and counterfeiting, became a significant concern. This paved the way for more secure technologies.

Enhanced Security: Embracing the Chip and PIN

The next major leap was the introduction of the EMV chip (Europay, Mastercard, and Visa). Chip and PIN technology significantly improved security by generating a unique transaction code for every purchase, making it incredibly difficult to clone or counterfeit cards. This shift from magnetic stripe to chip and PIN significantly reduced card-present fraud. Remember, as a future FinTech professional, understanding the importance of security is paramount.

The Wireless Revolution: Contactless Payments Take Center Stage

The emergence of wireless payments brought about unprecedented convenience. Contactless cards, powered by Near-Field Communication (NFC), allowed for tap-and-go payments. This technology utilizes radio waves to transmit data securely between the card and the terminal, making transactions faster and more efficient. NFC also underpins mobile payments, allowing smartphones and other devices to act as payment instruments.

The Rise of Digital Wallets: Mobile Payments and Beyond

The evolution continued with the rise of digital wallets and mobile wallets like Apple Pay, Google Pay, and Samsung Pay. These platforms securely store credit and debit card information, enabling users to make payments using their smartphones or other devices. Tokenization plays a crucial role here, replacing sensitive card data with unique tokens, further enhancing security. Biometric authentication, such as fingerprint scanning and facial recognition, adds another layer of protection against unauthorized access.

Strengthening Security: Two-Factor Authentication and Fraud Prevention

Security remains a constant focus. Two-factor authentication (2FA) adds an extra layer of security, requiring users to verify their identity through a second channel, such as a one-time password. Advanced fraud prevention measures leverage machine learning and AI to identify and prevent suspicious transactions in real-time. These security measures are crucial in mitigating risks associated with online transactions, e-commerce, and mobile payments.

The Future of Payments: Blockchain, Cryptocurrency, and Beyond

Looking ahead, technologies like blockchain and cryptocurrency are poised to disrupt traditional payment processing. Digital currency offers the potential for decentralized and secure transactions, while blockchain technology can enhance transparency and traceability. Furthermore, peer-to-peer (P2P) payments are gaining traction, facilitating direct money transfers between individuals without intermediaries. Virtual cards offer enhanced security for online transactions. The landscape of financial technology (FinTech) is constantly evolving, offering exciting possibilities for innovation.

Navigating the Regulatory Landscape: PCI DSS and Data Security

As we embrace these advancements, adhering to industry standards like the Payment Card Industry Data Security Standard (PCI DSS) is critical. PCI DSS sets the requirements for organizations that handle cardholder data, ensuring data security and protecting consumers from fraud. As future professionals, understanding and complying with these regulations is essential;

The evolution of credit card technology is a testament to human ingenuity. From the simple magnetic stripe to the complex world of digital wallets, blockchain, and beyond, we’ve witnessed incredible advancements in how we manage and transact money. As you embark on your FinTech journey, remember that continuous learning and adaptation are key to success in this dynamic and ever-evolving field. Embrace the future of finance and be a part of shaping the next generation of payment technology!

I appreciate the clear and concise explanation of NFC technology and its role in contactless payments. This is a fundamental concept for anyone working in the FinTech space. Keep in mind that the future of payments lies in seamless and secure transactions, and NFC is a major player in this arena.

Well done! The journey from magnetic stripe to digital wallets is a testament to continuous innovation in the payment industry. As you continue your FinTech journey, consider how these technologies are converging and the potential for further disruption in the financial landscape. Think about biometric authentication, blockchain, and the Internet of Things.

Excellent overview of the evolution of credit card technology. Highlighting the vulnerabilities of magnetic stripe cards and the subsequent advancements in security with chip and PIN is crucial for aspiring FinTech professionals. Remember, understanding the history of payment systems is key to innovating for the future.