Credit card fraud, a pervasive form of financial crime, has a significant impact on the global economy. From individuals to businesses and governments, the ripple effects of this illicit activity are widespread and costly. This article explores the various facets of credit card fraud, its global implications, and the ongoing efforts to combat it.

The Mechanics of Credit Card Fraud

Credit card fraud encompasses a range of illicit activities aimed at stealing credit card information and using it for unauthorized transactions. These activities include:

- Card Skimming: Physically stealing card data using devices attached to ATMs or POS terminals.

- Phishing Attacks: Deceptive emails or websites tricking users into revealing their credit card details.

- Data Breaches: Large-scale theft of credit card data from merchants or financial institutions.

- Account Takeover: Gaining unauthorized access to an existing credit card account.

- Merchant Fraud: Dishonest merchants processing fraudulent transactions.

- Online Fraud: Using stolen card details for unauthorized online purchases.

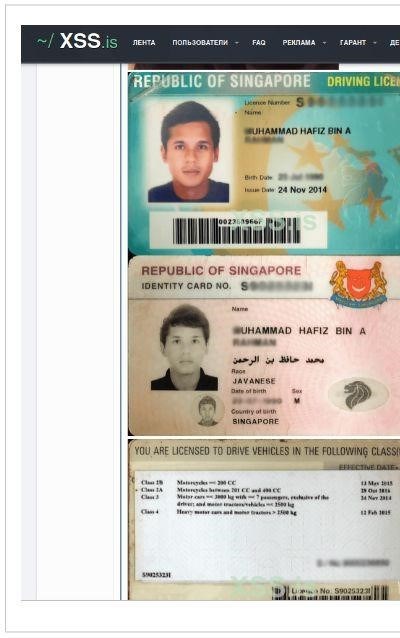

- Identity Theft: Using stolen credit card information to assume someone’s identity.

The Global Economic Impact

The ramifications of credit card fraud extend far beyond individual financial losses. The global economy bears a substantial burden, including:

- Financial Losses: Billions of dollars are lost annually due to unauthorized transactions, chargebacks, and the costs associated with fraud investigation and prevention.

- Increased Costs for Businesses: Merchants face chargebacks, higher transaction fees, and investments in fraud detection and prevention technologies.

- Impact on Consumer Confidence: Fear of fraud can erode consumer trust in online commerce and contactless payments, hindering economic growth.

- Strain on Law Enforcement: Cybercrime units are stretched thin investigating and prosecuting increasingly sophisticated fraud operations.

- Damage to Brand Reputation: Businesses experiencing data breaches suffer reputational damage and loss of customer loyalty.

Combating Credit Card Fraud

The fight against credit card fraud requires a multi-pronged approach involving individuals, businesses, and regulatory bodies:

- EMV Chip Cards: The adoption of EMV chip cards has significantly reduced card-present fraud.

- Contactless Payments Security: Tokenization and other security measures are implemented to protect contactless transactions.

- Fraud Detection and Transaction Monitoring: Advanced algorithms and machine learning are used to identify and flag suspicious transactions.

- Consumer Protection Measures: Educating consumers about online security best practices and providing resources for reporting fraud.

- Regulatory Compliance: Regulations like PCI DSS aim to enforce data security standards for businesses handling credit card information.

- Data Security: Robust data security measures are crucial for protecting sensitive information from data breaches.

- Fraud Prevention Strategies: Implementing multi-factor authentication, address verification, and other fraud prevention tools.

- International Cooperation: Cross-border collaboration is essential to combat global cybercrime networks.

Credit card fraud poses a significant threat to the global economy. As cybercrime continues to evolve, ongoing vigilance and collaboration are vital to mitigate its impact. By implementing robust security measures, promoting consumer awareness, and fostering international cooperation, we can strive towards a more secure financial landscape.

Keywords: credit card scams, online fraud, identity theft, data breaches, phishing attacks, cybersecurity threats, financial crime, consumer protection, fraud detection, EMV chip cards, contactless payments, payment security, e-commerce fraud, chargebacks, merchant fraud, card skimming, account takeover, unauthorized transactions, financial losses, global economy, fraud prevention, regulatory compliance, data security, cybercrime, online security, payment fraud, transaction monitoring.

I recently had a scare with a potential phishing attack, and this article really hit home. It made me realize how vulnerable we all are to these kinds of scams. I’m definitely more cautious now about where I enter my credit card information online. It’s a scary world out there!

This article is a must-read for anyone who uses a credit card. I was shocked to learn about the different ways criminals can steal your information. I’ve already started taking extra precautions, like checking my statements more regularly and being more careful about using public Wi-Fi. Knowledge is power!

I found this article incredibly informative and well-written. It clearly explains the complexities of credit card fraud and its impact on the global economy. I appreciated the practical advice on how to protect yourself from becoming a victim. I feel much more informed and empowered after reading this.