As a seasoned professional in cybersecurity and fraud prevention‚ I understand the temptations that exist in the murky world of illicit activities like purchasing stolen credit card information («CC Fullz»)․ However‚ I implore you to consider the severe legal and ethical ramifications of such actions․ Engaging in activities involving stolen credit cards‚ purchasing card data from illicit credit card markets like dark web carding forums‚ or using fake credit cards is not only illegal but also fuels a dangerous ecosystem of cybercrime‚ identity theft‚ and financial fraud․

Instead of risking your future and contributing to the victimization of others‚ let’s explore legitimate payment methods and ethical online shopping practices․ There are numerous alternatives to buying CC Fullz that offer secure online transactions and peace of mind․

Secure and Legitimate Alternatives

Embracing ethical online shopping habits and utilizing legitimate payment methods is crucial for building a secure and trustworthy digital experience․ Here are some practical alternatives to consider:

1․ Digital Wallets:

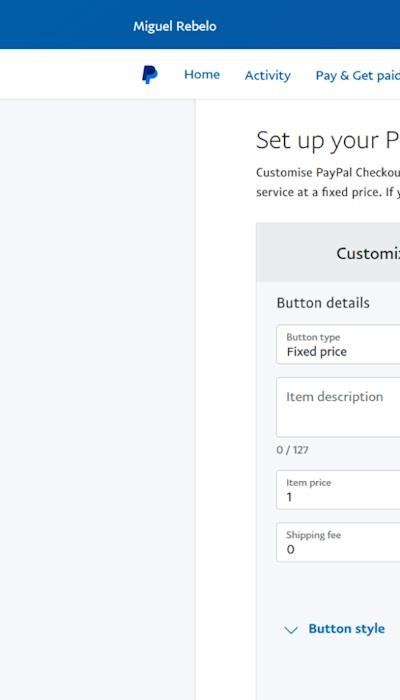

Digital wallets offer a convenient and secure way to store your credit and debit card information‚ eliminating the need to repeatedly enter your details during online purchases․ These platforms often employ robust security measures‚ including tokenization and two-factor authentication‚ to protect your sensitive data from compromised credit cards and data breaches․ Examples include Apple Pay‚ Google Pay‚ and PayPal․

2․ Prepaid Cards:

Prepaid cards allow you to load a specific amount of money onto a card‚ providing a controlled spending limit and minimizing the risk of financial fraud should your card be lost or stolen․ This method is particularly beneficial for online transactions‚ limiting potential losses to the amount loaded on the card․

3․ Bank Transfers:

Utilizing direct bank transfers for online purchases offers a secure and reliable alternative to credit cards․ This method eliminates the need to share your card details online‚ reducing the risk of phishing attacks and malware designed to steal your information․

4․ Cryptocurrency Payments:

While still relatively new‚ cryptocurrency payments offer a degree of anonymity and security․ However‚ it’s crucial to understand the volatility of cryptocurrencies and the potential risks involved before using them for online transactions․

Protecting Yourself from Credit Card Fraud

Beyond using alternative payment solutions‚ proactive fraud prevention is essential․ Here’s how you can enhance your credit card security:

- Strong Passwords and Two-Factor Authentication: Use unique‚ strong passwords for all your online accounts and enable two-factor authentication wherever possible․

- Be Wary of Phishing Scams: Never click on suspicious links or attachments in emails or text messages․ Verify the legitimacy of any communication purporting to be from your bank or financial institution․

- Regularly Monitor Your Accounts: Keep a close eye on your bank and credit card statements for any unauthorized transactions․ Report any suspicious activity immediately․

- Keep Your Software Updated: Ensure your operating system‚ antivirus software‚ and web browser are up-to-date to protect against malware and other cyber threats․

Building a Secure Online Presence

Remember‚ secure online transactions are a two-way street․ Choosing legitimate payment methods and being vigilant about your online security practices will significantly reduce your risk of becoming a victim of credit card fraud‚ identity theft‚ and other forms of cybercrime․ Let’s work together to build a safer and more trustworthy digital environment by embracing ethical online shopping and promoting credit card security․

Stepping away from the shadows of illicit credit card markets and embracing secure online transactions is not only the right thing to do‚ it’s the smart thing to do․ Protect yourself‚ protect others‚ and choose the path of legitimacy;

This piece provides a concise yet comprehensive overview of the risks associated with illicit credit card activities. The emphasis on ethical considerations is particularly commendable, reminding readers of the broader societal impact of such choices. The suggested alternatives are practical and readily accessible, offering a clear path towards secure online transactions.

I appreciate the balanced approach taken in this article. It acknowledges the allure of illegal activities while firmly advocating for ethical and legal alternatives. The clear and concise language makes the information accessible to a wide audience, maximizing its potential impact in promoting safe online practices. The section on digital wallets and prepaid cards is particularly informative and helpful for those seeking secure payment options.

Excellent work in highlighting the dangers of engaging with stolen credit card information. The explanation of legitimate payment alternatives is well-structured and easy to understand, empowering readers to make informed decisions about their online security. The focus on preventative measures, rather than just reactive solutions, is a key strength of this piece.